With nearly 40,000 companies employing and relying on NetSuite as their ERP of choice, the popular platform has helped them achieve substantial insights into their business processes. The journey for these began once the system went live, however, the more crucial phase – monitoring and optimizing NetSuite to ensure they’re reaping maximum benefits is an ongoing process that needs to be discussed.

Tracking key metrics post-NetSuite go-live is essential for a deeper understanding of performance, identifying areas for improvement, and driving business growth. Below, we will explore what metrics you should be tracking and how to leverage them to continuously enhance your operational and financial strategies – making sure your investment pays off.

Efficiency Metrics Relating to NetSuite

Measuring efficiency metrics is likely one of the more apparent metrics you want to delve into so you can see how effectively the platform is utilized to streamline operations, improve productivity, and optimize your resources. Ask your team about cycle time reduction by measuring the time taken from order to cash and other critical processes before and after implementation. Measure your transaction processing time, which indicates how efficiently transactions are processed within the system.

Take a look at process automation, which involves monitoring the execution and outcomes of automated tasks and workflows and tracking the percentage increase and its impact on operational efficiency. For instance, in SuiteFlow, you can view the workflow status and history. You can also check the audit trail, as each workflow action can be audited to track when it was triggered and executed.

NetSuite also offers event monitoring capabilities that track user activity and system events, which can include tracking when automated processes are triggered and executed.

Cost Savings Metrics due to NetSuite Implementation

As one of the more significant metrics, measuring costs can be done in a few ways. Firstly, take a look and see if there is a reduction in IT costs. Compare the pre-ERP and post-ERP costs, including maintenance, support, and infrastructure. Secondly, examine administrative costs by taking a dive into changes in administrative costs due to the now streamlined processes and reduced manual work due to the many automations offered in NetSuite. Next, you can measure procurement savings by looking at the savings in procurement through improved vendor management and purchasing processes.

Measure your labor costs by evaluating changes in staffing requirements for finance, accounting, and IT departments. with regard to compliance and risk management, take a look and see if there was a reduction in costs associated with improved compliance and reduced risk of fines and penalties.

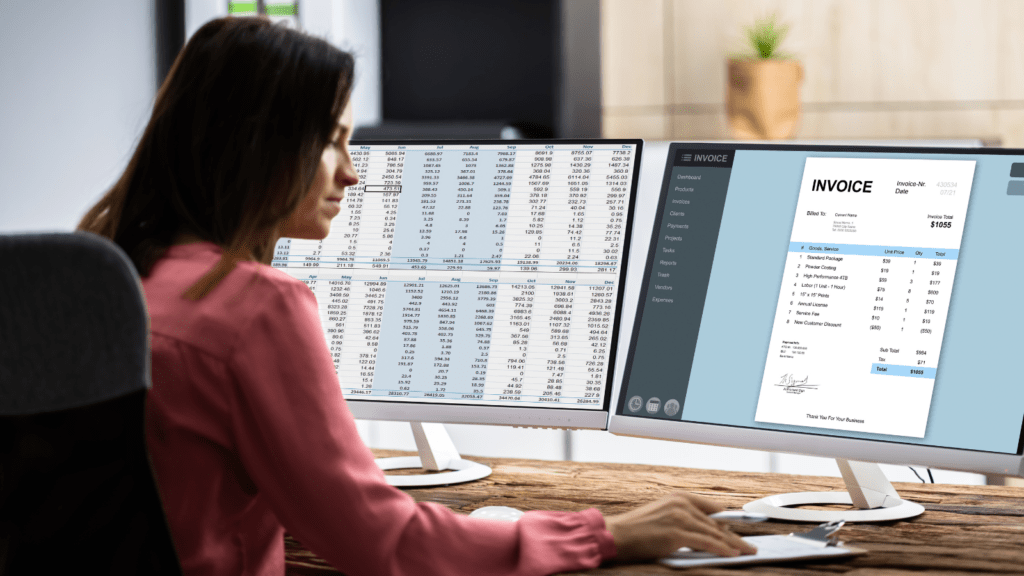

Examine Financial Metrics from Implementing NetSuite

Likely, one of the more significant metrics to examine is financial. Companies want to know if their investment in NetSuite has paid off. There are several financial metrics that can be looked at, starting with revenue growth. Monitor revenue trends post-ERP implementation to identify any positive impacts on sales and profitability. You can also look at profit margins by evaluating changes, considering cost reductions and revenue growth facilitated by NetSuite. Businesses can also examine cash flow and assess improvement in cash flow management and liquidity due to better financial controls and forecasting capabilities.

Return metrics are also significant, so look at your ROA (return on assets) to measure how effectively assets are being used to generate profit. Look at your ROE (return on equity) if you have shareholders. NetSuite can also provide Gross Profit Percentage, EBITDA, Debt Covenants, and Current Ratio.

Customer Satisfaction Metrics

Looking into your customers’ satisfaction sometime after a NetSuite implementation is a great way to see if it’s paying off outside of your organization. Take a look at order fulfillment and track improvements in order accuracy, fulfillment speed, and customer satisfaction scores. Examine service response times by measuring the changes in response times and service levels post-ERP to gauge customer service improvements. Finally, analyze customer retention rates and repeat business post-ERP implementation. These are all ways to get a comprehensive view of customer satisfaction and identify areas for improvement after implementation.

Reporting and Analytics Metrics post NetSuite Go-Live

NetSuite affords users exceptional reporting and analytics capabilities, so you will want to measure some elements to ensure that you’re getting the expected business value. Some key metrics to consider include data accuracy and integrity metrics. For data accuracy, evaluate the precision and reliability of financial and operational data post-ERP. You can also track the frequency of data entry errors or system-generated errors, and also measure the percentage of data fields that are filled out correctly. Take a look at real-time reporting by measuring the efficiency and speed of generating reports and dashboards. Finally, take a look at user adoption by assessing user engagement and adoption rates of NetSuite features and reporting tools.

Employee Productivity Metrics Utilizing NetSuite

Evaluating your return on investment can also be measured by looking at employee productivity after NetSuite implementation. Take a look at time savings, and calculate time saved per employee in performing routine tasks and accessing information. Look at training effectiveness, and measure how effective NetSuite training programs were in improving employee productivity. Another thing to consider is employee satisfaction – gauge employee satisfaction and morale changes post go-live and see what these changes have brought to your user teams.

The importance of tracking metrics post NetSuite implementation is vital to finding out if your investment was worth the time, effort, and money. Making informed decisions comes with continuously optimizing your system, and the only way to do that is by examining these metrics mentioned above. Continuous evaluation and adjustment of metrics will ensure ongoing success and a good return on your investment.

To learn more about how your organization can benefit from a NetSuite implementation or optimization, contact us in the form below.